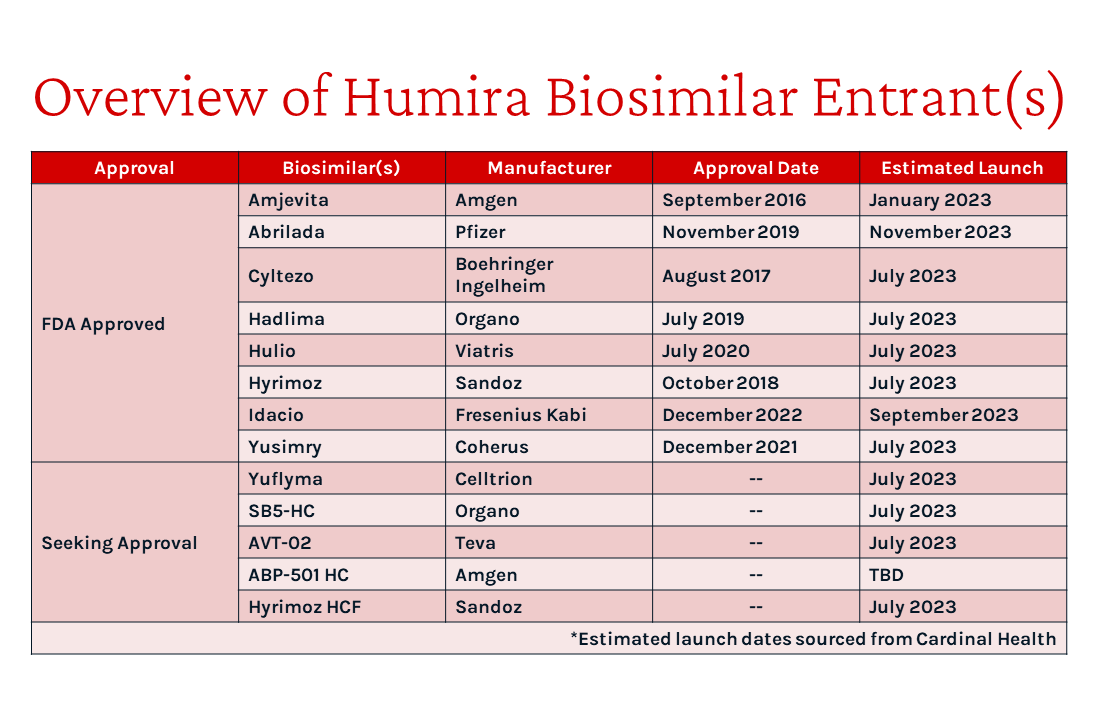

In late January, Amgen announced commercial availability of the first approved Humira (adalimumab) biosimilar, Amjevita¹. Amgen’s announcements come after several years of legal battles with AbbVie, the manufacturer of Humira². Humira generates more revenue for AbbVie than any other medicine across its 10 indications, with $18.6 billion in the United States alone last year³. By the end of the year, 12 other Humira biosimilar products are expected from 10 manufacturers.⁴

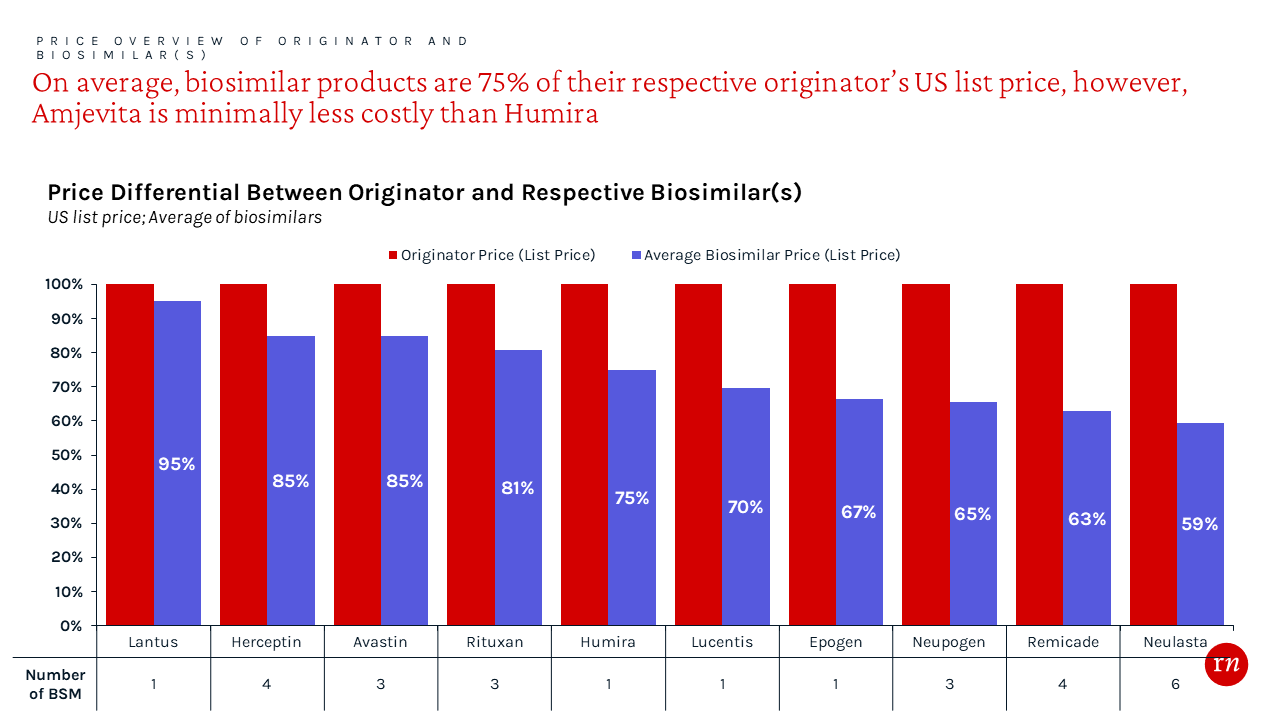

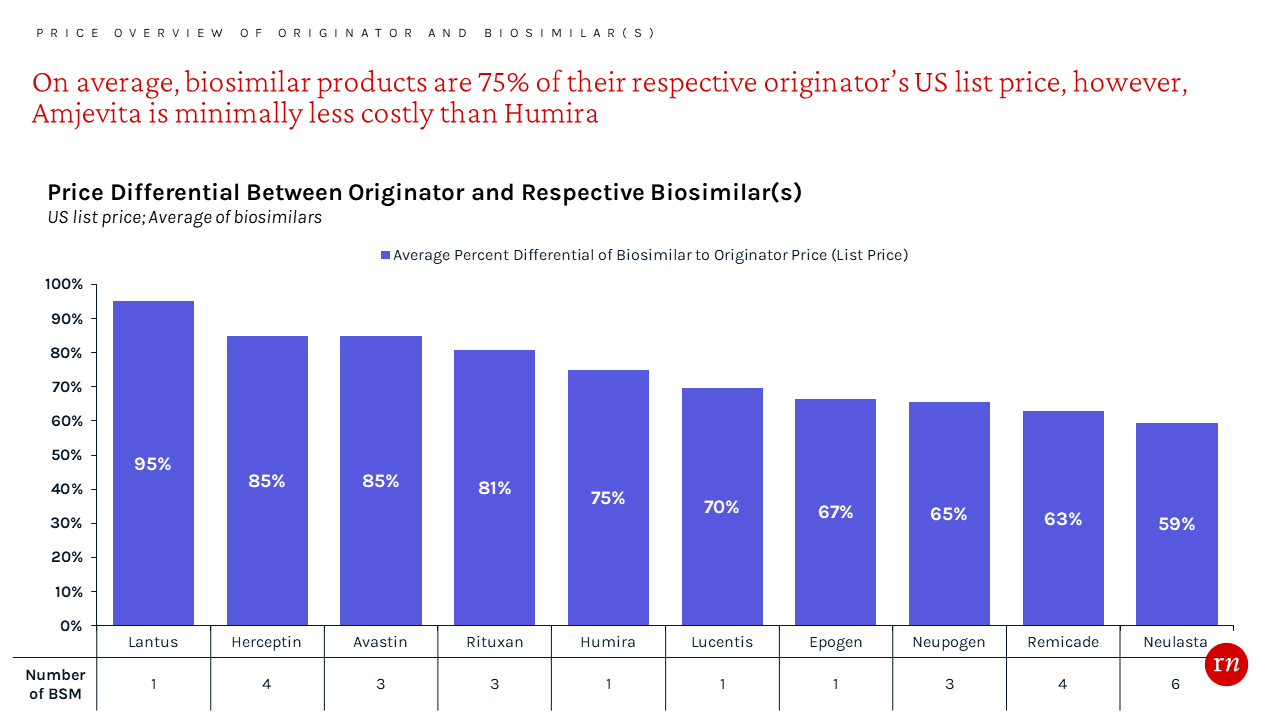

Amgen will offer 2 forms of Amjevita at a 5% and 55% discount to Humira’s list price, respectively. These options provide payers and PBMs with both a low and high rebate option yielding a similar net price.⁵ Amgen likely aims to satisfy both health plan and PBM market segments by appealing to each with a different pricing strategy since PBMs often earn revenue as a percentage of rebates.

Similarly, Mylan launched Semglee (insulin glargine-yfgn), the first approved interchangeable biosimilar for Lantus, at two list prices in 2021. Upon launch, pharmacy benefit manager (PBM) Express Scripts preferred the higher wholesale acquisition cost (WAC) price / higher rebate version of Semglee on their largest commercial formulary.⁶ Amgen likely anticipates a similar experience with Amjevita.

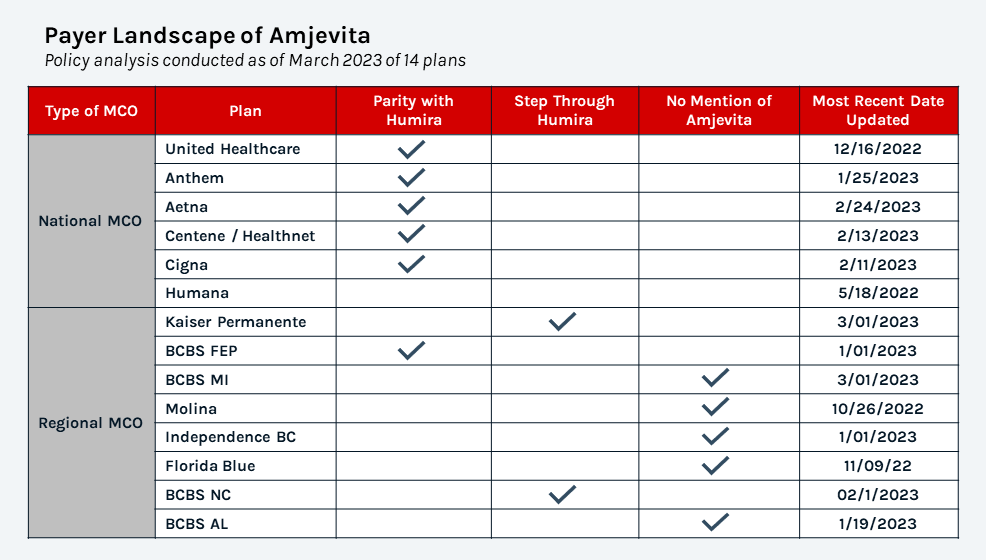

To date, many payers have not made formulary decisions public. Among those that have:

- UnitedHealthcare has announced Humira will continue to be on all prescription drug lists (PDL) but will also add up to three biosimilars to the same tier, beginning with Amjevita⁷.

- Similarly, Cigna reported that it will add specific Humira biosimilars to the preferred product list on commercial formularies at the same position as Humira⁸

- Aetna will cover Humira and Amjevita at parity for their commercial formularies⁹

- Kaiser Permanente and Blue Cross Blue Shield North Carolina will continue preferring Humira, and implement a step through Humira prior to accessing Amjevita¹⁰, ¹¹

- The major PBMs (Express Scripts, Prime Therapeutics, and Optum Rx), who often manage formulary decisions for smaller health plans, report they will add Humira biosimilars alongside Humira on their PDLs as they continue to evaluate the impact on cost.¹², ¹³

So far, the payer response has been anything but aggressive, likely due to hesitancy in force switching clinically stable patients and the associated risk of losing Humira rebate dollars before knowing they can switch patients over to the biosimilar. Prior to launch, there was discussion of stepping naïve patients only, like with other biosimilars, but payers are not even doing that. Interestingly, AbbVie seems content in allowing biosimilars to have parity access because they are not pulling their rebates, as evidenced by the continued co-preferred status of Humira. AbbVie likely figures co-preferred status is sufficient to at least maintain their market-leading position. In fact, Humira may be commanding a net price premium above Amjevita by leveraging their existing patient base which payers are hesitant to force switch. Although, it is hard to imagine payers would not step naïve patients through the cheaper agent if Humira is indeed at a premium to Amjevita. Moreover, it is difficult to imagine Kaiser and BCBS NC stepping Amjevita through a more costly Humira.

However, with many additional Humira biosimilars launching later this year, we expect net prices to continue to decrease as often occurs in competitive marketplaces (e.g., generics, other biosimilars, therapeutic categories with numerous clinically similar agents). Payers may become tempted by larger potential cost savings due to larger net price concessions due to increased biosimilar competition; the landscape will be momentously different at the end of the year with 12 more Humira biosimilars expected.

As is the case with generics, treatment costs can be reduced by using biosimilars instead of their more costly originators. To gain preferred access, manufacturers typically price their biosimilars at both a significant WAC and net price discount via payer rebates.¹⁴ The average WAC price discount from the originator is approximately 25% in aggregate. However, the net price is likely even lower as additional, confidential rebates can contractually obligate payers to provide access and/or prefer a molecule over others in the formulary.

As additional biosimilars enter market in mid 2023, access is anticipated to become increasingly competitive resulting in more restrictive management, such as step therapy.

While 6 plans have launched Amjevita at parity to Humira, 2 regional plans are currently stepping Amjevita through Humira highlighting the more aggressive management as more biosimilars enter market

While biosimilar manufacturers’ pricing and contracting strategy is designed to secure access, many payers attempt to maximize rebates by preferring the molecule (biosimilar or originator) with the lowest net price. This single preferred strategy often extracts the largest possible discount across a molecule but necessitates force switching clinically stable patients, assuming the product doesn’t have a limited duration of therapy. So far, we have not seen many payers employ this strategy with Humira likely due to the sensitivity of forcing clinically stable patients to switch medications. However, we have seen this with Remicade; UnitedHealthcare required patients to use preferred biosimilar Remicade (Inflectra or Avsola) even if members are already on the non-preferred infliximab products. UnitedHealthcare specifies that to continue coverage, members currently taking Remicade or another non-preferred biosimilar will be mandated to change to the preferred products unless there is documentation of a failure or physician attestation that non-preferred products will provide a clinically superior result.¹⁵

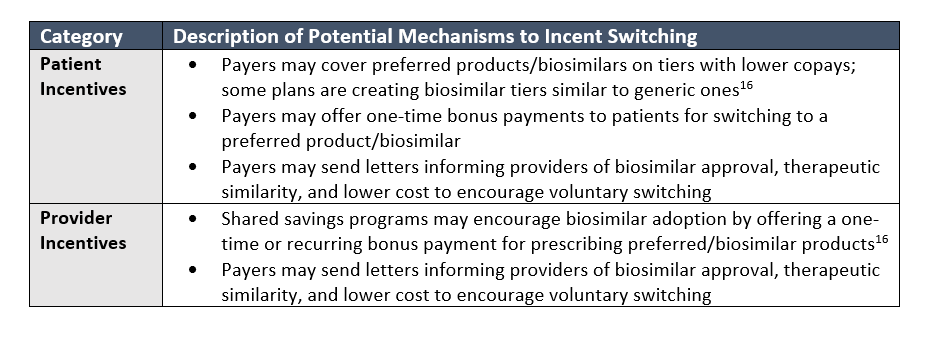

Payers seem to appreciate having multiple biosimilars on formulary, often alongside the originator, to offer options to their beneficiaries and providers. This apparently includes the option of remaining on a potentially more costly originator if patients have been stable on it; however, originators are likely discounting close to parity with the biosimilars given the lack of steps on naïve patients. These payers are trying to maintain positive relationships with their provider networks and beneficiaries, and positively differentiate their benefit designs. By including a few biosimilar in their formularies, these payers still receive significant rebate value, albeit less than the scenario of a single preferred agent, while keeping some choice of molecule for patients and their providers. These payers will likely focus on incentivizing patients and providers to voluntarily switch to a less costly biosimilar through various initiatives and mechanisms.

Conclusion

Going forward, we expect providers to become more comfortable with biosimilars given the sheer number of potential patients switching away from Humira with even only a few plans preferring a biosimilar. We expect this effect to spill over to other brands with biosimilar competition and generally increase provider and payer willingness to utilize biosimilars. This in turn will increase the competitive intensity of the biosimilar marketplace more broadly as payers become more willing to be more aggressive. Ultimately, this could result in more aggressive discounting and rebating by other non-Humira biosimilars as they try to secure favorable access and uptake.

Red Nucleus will continue to monitor the situation as we engage with numerous clients on the topic. Contact us to discuss how we may help you better understand the situation and develop an appropriate strategy.

Resources

https://www.centerforbiosimilars.com/view/us-welcomes-first-adalimumab-biosimilar-amjevita

https://investors.abbvie.com/static-files/b348f3b1-84d1-41f6-ba6e-4cd17953fd8d

https://newsroom.cigna.com/cigna-offering-equal-access-to-new-biosimilars-humira-next-year

https://www.centerforbiosimilars.com/view/part-4-how-payers-can-prepare-for-adalimumab-biosimilars