IRA Overview

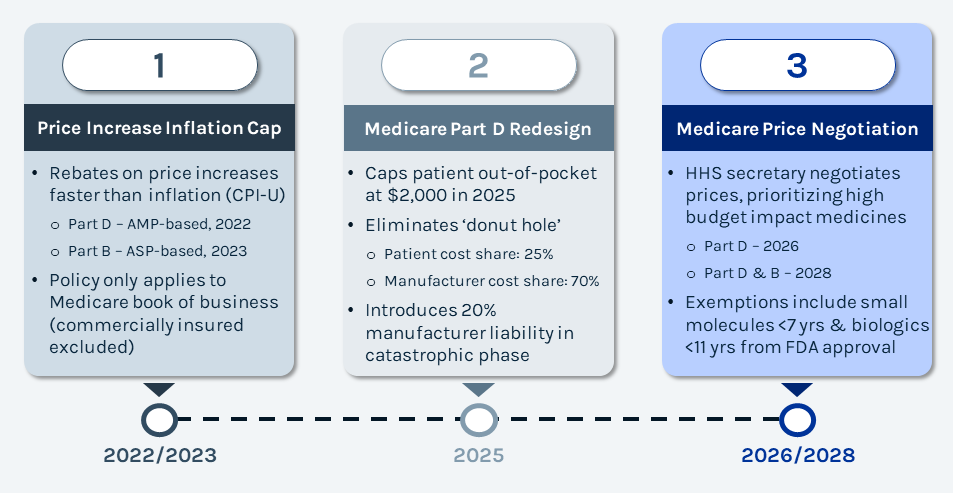

The Inflation Reduction Act (IRA) came into effect on August 16, 2022, with the objective of lowering prescription drug costs for Medicare. The IRA does so by overhauling Medicare’s approach to drug pricing and patient cost-sharing, greatly impacting commercial value dynamics for drug manufacturers. The IRA can be summarized by 3 points of emphasis:

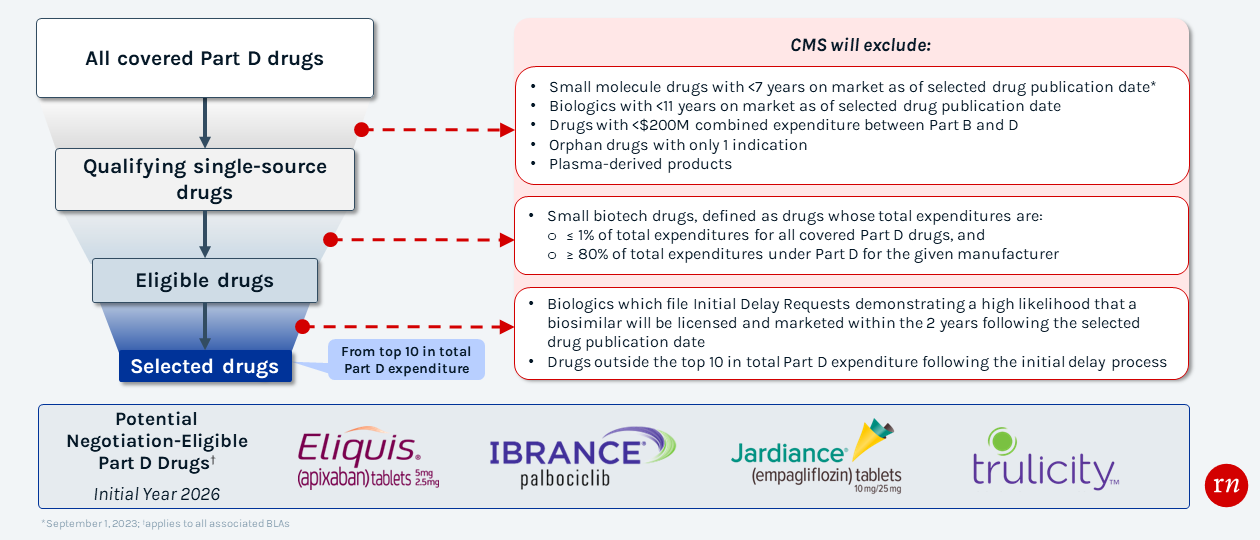

Price Negotiation Selection Process for 2026

CMS' selection process for Medicare negotiations will prioritize high budget impact therapies; however, there are exclusion criteria in specific cases (i.e., small biotechs).

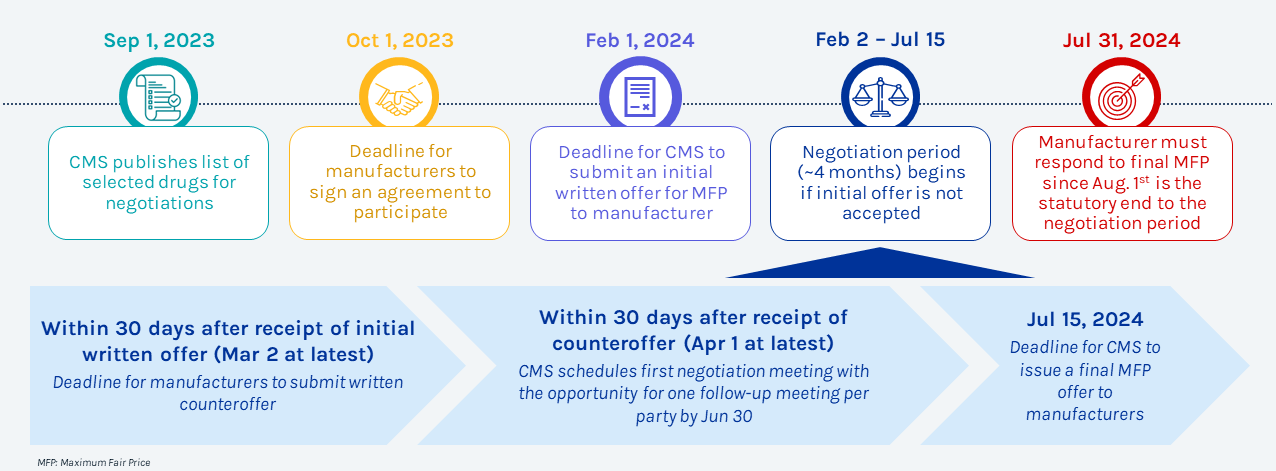

Timeline

Key activities and milestones for first Medicare Negotiation in 2026

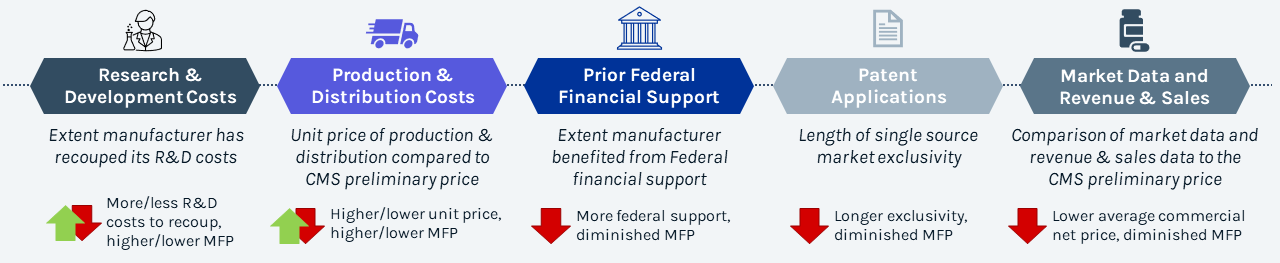

Negotiation Factors

Along with comparative clinical benefit, manufacturer-specific data* is a key factor that may adjust maximum fair price

Justification of Maximum Fair Price

- The starting point for CMS’ initial MFP is generally based on net price and/or ASP of therapeutic alternative(s)

- CMS will adjust MFP to account for comparative clinical benefit and manufacturer-specific data, but implications on adjustment amount and weight of criteria are unclear

- CMS will evaluate outcomes and safety profile vs. therapeutic alternatives using existing literature, RWE, internal analytics, and consultations from subject matter and clinical experts to determine relative clinical benefit

- To ensure manufacturer costs are recouped, price may be adjusted based on manufacturer provided evidence

- Renegotiations provide parties the opportunity to justify the proposed MFP by leveraging negotiation factors

*Manufacture specific data will be treated as strictly confidential by CMS throughout the negotiation process; R&D: Research and Development, MFP: Maximum Fair Price, ASP: Average Sale Price, RWE: Real-World Evidence

Maximum Fair Price Ceiling

There are two methodologies for calculating the MFP ceiling.

- MFP ceiling will be set as the lower value of the two methodologies, and will be included by CMS in the written initial offer to better contextualize the suggested MFP

- MFP is calculated as a 30-day supply to create a single MFP to apply across all dosage formulations and strengths for the selected drug; MFP is applied for individuals enrolled in a prescription drug plan under Medicare Part D if coverage is provided under such plan

- Drugs with the same active moiety and same manufacturer under different NDAs will be aggregated as a single potential qualifying single source drug

*Manufacturers are not responsible for providing MFP to 340B eligible entities if the 340B ceiling is below the MFP ceiling price ; MFP: Maximum Fair Price, Non-FAMP: Non-Federal Average Manufacturer Price, NDA: New Drug Application

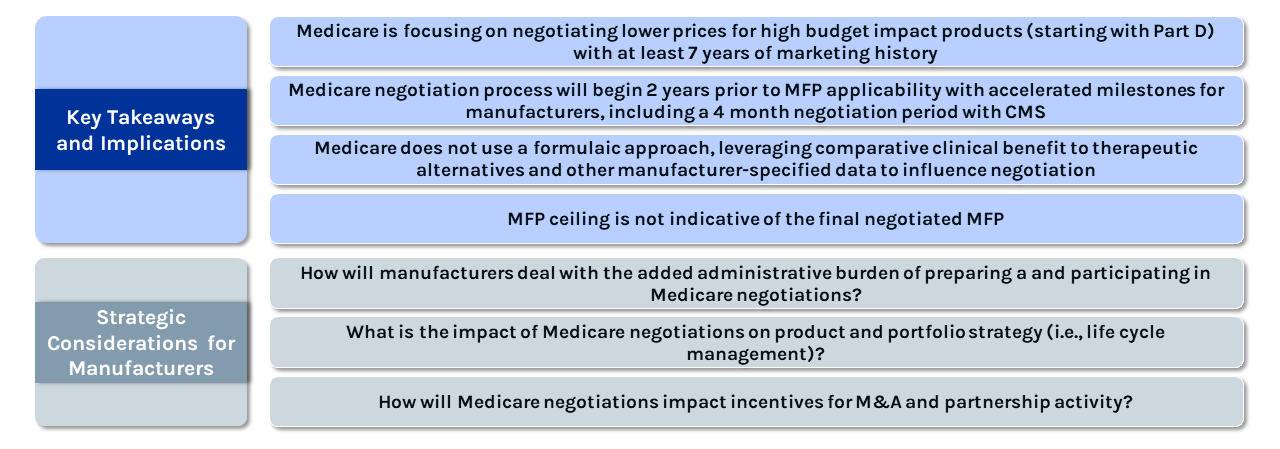

Key Considerations for Manufacturers

If selection for negotiation is likely, conducting simulations to determine internal stakeholders, data requirements, and processes is key to effectively navigate Medicare negotiations. Contact Red Nucleus MACS for additional insights on Medicare negotiations and simulation guidance.

Reference

Seshamani, M. (2023, March 15). Medicare Drug Price Negotiation Program Initial Guidance [Memorandum]. Department of Health & Human Services. https://www.cms.gov/files/document/medicare-drug-price-negotiation-program-initial-guidance.pdf