The Centers for Medicare & Medicaid Services ("CMS") released a proposed rule titled "Medicaid Program; Misclassification of Drugs, Program Administration and Program Integrity Updates Under the Medicaid Drug Rebate Program" on May 26, 2023. The adoption of this rule would bring about substantial alterations in manufacturers' responsibilities and the

enforcement measures they could face within the Medicaid Drug Rebate Program (MDRP).

Within the framework of the MDRP, manufacturers bear the responsibility of adhering to precise reporting obligations on a quarterly basis and must pay rebates to state Medicaid programs based on the submission and certification of data pertaining to the average manufacturer price (AMP) and Best Price (BP) of drugs used by Medicaid beneficiaries. The Proposed Rule brings a series of alterations aimed at elucidating and refining these reporting obligations, as well as delineating the potential ramifications in cases where accurate and timely reporting is not upheld.

This analysis delves into the challenges and opportunities faced by manufacturers due to the potential adoption of this rule, with a focus on the components relating to Best Price reporting. The comment period for the Proposed Rule ends on July 25, 2023.

Background

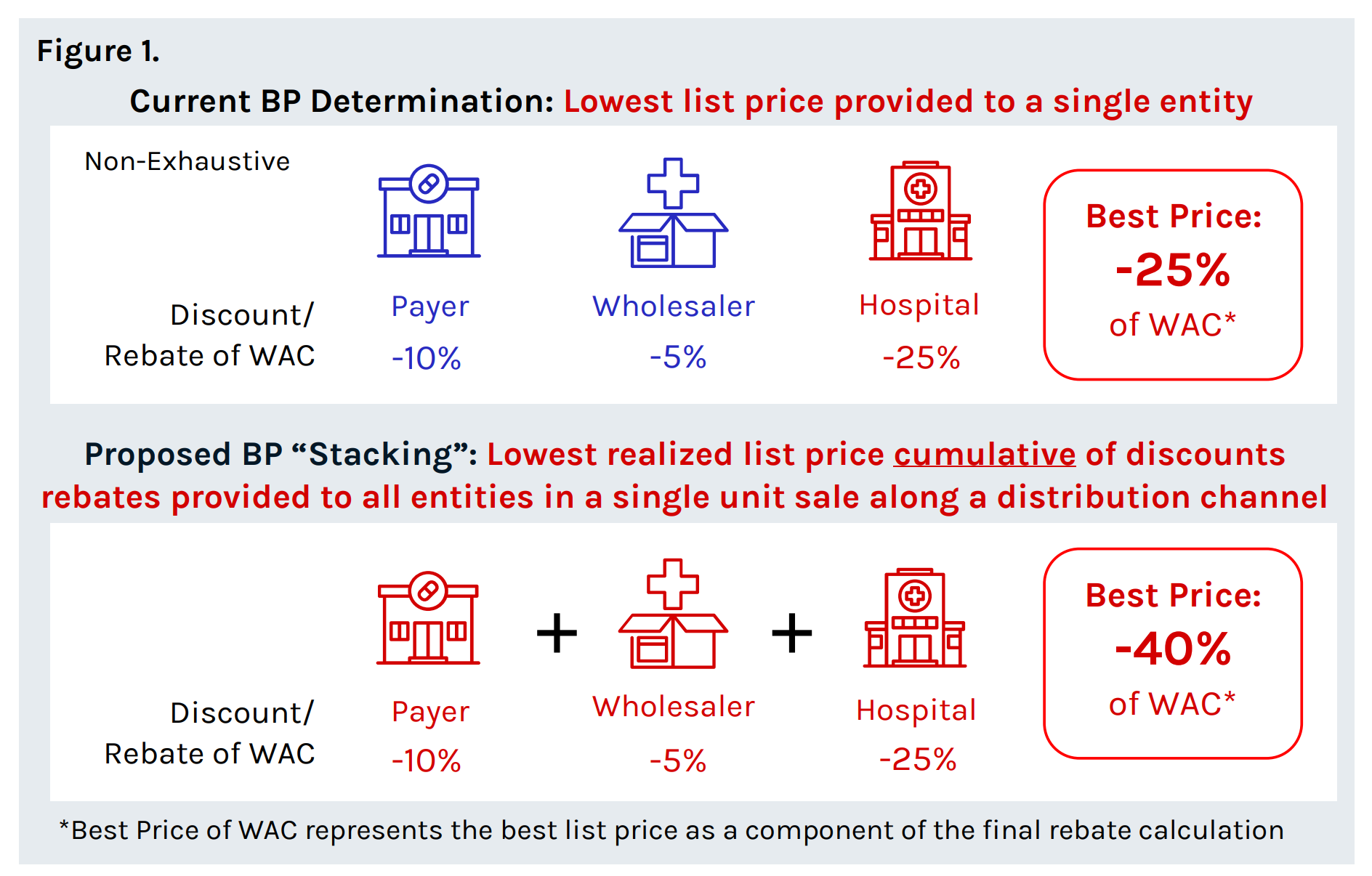

Medicaid Best Price, a provision established under the Omnibus Budget Reconciliation Act of 1990 (OBRA '90), is aimed at ensuring affordable access to medications for Medicaid beneficiaries. It has significantly shaped the landscape of pharmaceutical pricing and gross-to-net dynamics in the United States, and it is crucial to understand the impact of Medicaid Best Price on pharmaceutical manufacturers. Currently, manufacturers are required to pay rebates of 23.1% of AMP, or AMP minus the best price paid by any purchaser, whichever amount is greater (exceptions exist for certain drug classes, such as blood products, pediatric products, etc.). As part of the current Drug Misclassification Proposed Rule, CMS proposes to modify what constitutes Best Price through the accumulation of price concessions that a manufacturer provides for a covered outpatient drug (COD).

Manufacturer Participation in the MDRP

Manufacturers are broadly defined as an entity that holds the National Drug Code (NDC) for any pharmaceutical product. However, there is a grey area that lacks clarity in the participation requirements for subsidiary entities, which the proposed rule seeks to address, such that “all associated entities of the manufacturer that sell prescription drugs, including but not limited to owned, acquired, affiliates, brother or sister corporations, operating subsidiaries, franchises, business segments, part of holding companies, divisions, or entities under common corporate ownership or control”1 would be included in the MDRP.

“Stacked” Best Price Reporting

Under the current statute 42 U.S.C. § 1396r-8(c)(2), (3)(C), the definition of Best Price has been interpreted as the single lowest price to a single entity (“purchaser”) for a drug. In the Proposed Rule, CMS proposes further clarity for this regulation requiring manufacturers to combine (“stack”) all discounts offered to all different and unrelated entities within the distribution chain in a single COD unit sale when determining the Best Price. As a result of this change, following the journey and aggregating each applicable price concession across multiple entities (e.g., wholesaler, retailer etc.), best price on many drugs is likely to decrease dramatically.

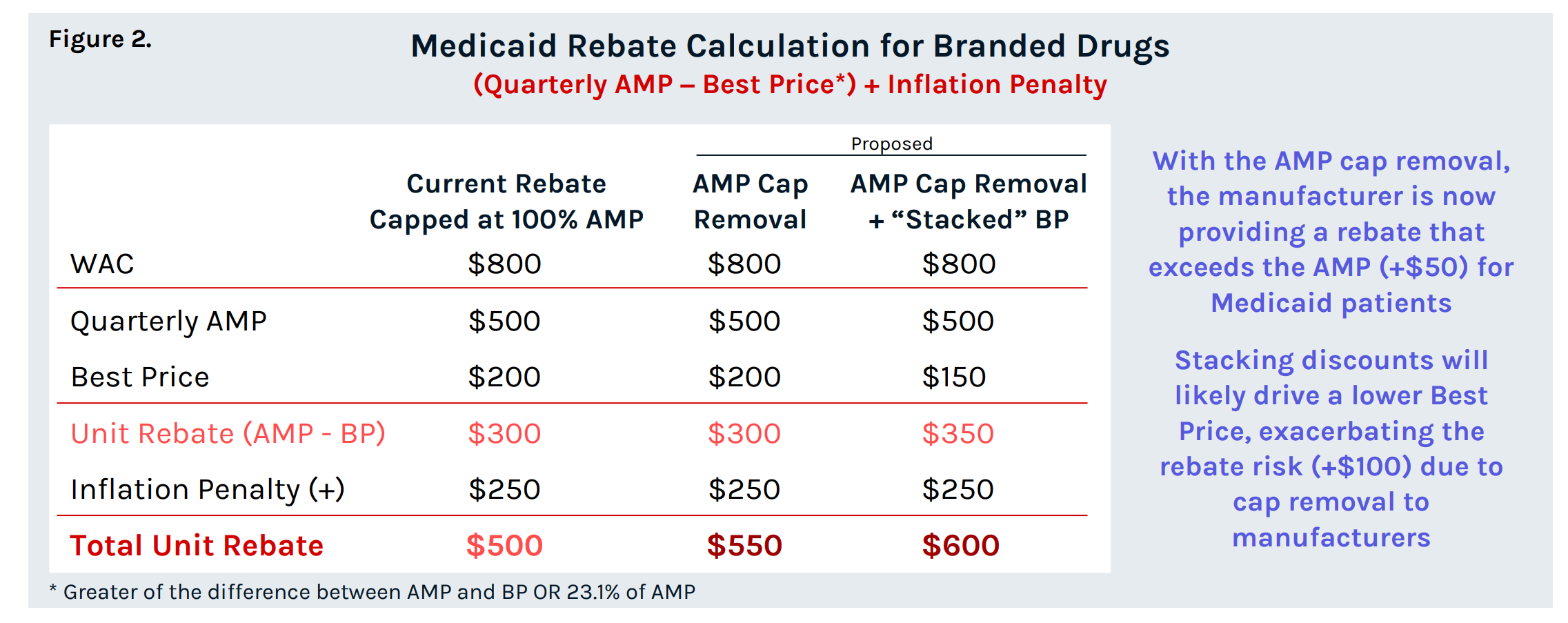

Amp Cap Removal on Manufacturer Rebates

For drugs with list price increases that exceed CPI-U, manufacturers are subject to an inflation penalty that can push the total unit rebate amount to exceed AMP. Manufacturer rebate obligations are currently capped at 100% of quarterly AMP for a single source, innovator multiple source, and non-innovator multiple source drugs. For manufacturers that reach this rebate ceiling, list prices can continue to increase without incurring additional Medicaid rebates. To “conform to statutory amendments section 1927(c)(2)(D) of Act, as amended by the American Rescue Plan Act of 2021, and sections 1927(c)(3)(C)(i), (ii)(IV), and (ii)(V) of the Act CMS proposes that this AMP cap ends on December 31, 2023 for all drugs. The cap removal, paired with the proposed “stacked” Best Price poses a significant risk for drugs that are already capped at or approaching the cap of 100% of AMP in terms of higher Medicaid rebate liability, and in some cases, the potential for the Medicaid rebate to exceed the WAC. This will also impact 340B price calculations such that more drugs will approach the 340B price ceiling and be subject to penny-pricing. If accepted, these changes are set to have sweeping ramifications across the industry, potentially altering the commercial appeal of Medicaid business. Thorough evaluation is crucial to understand the magnitude of their impact.

Key Considerations for Manufacturers:

• How will manufacturers balance the financial implications resulting from a “stacked” Best Price across the portfolio?

• How will manufacturers consider proposed rules in developing their pricing and contracting strategies across key stakeholders?

• What will be the effect on manufacturers’ ability to maintain competitive pricing in the market?

• What is the impact of the “stacked” Best Price on product and portfolio strategy (i.e., life cycle management)?

• How will MDRP pricing requirements impact diseases that disproportionally impact Medicaid populations (i.e., mental health, pediatric conditions, etc.)?

• How will MDRP pricing requirements affect price-value perceptions for non-Medicaid payers?

Contact Red Nucleus MACS for additional insights on Medicaid Drug Rebate Program and assistance in quantifying financial impacts and providing strategic guidance on how to optimize product and portfolio value, price, and access strategies as a result of the acceptance of this CMS proposed rule.

References: 1. Medicaid Program; Misclassification of Drugs, Program Administration and Program Integrity Updates Under the Medicaid Drug Rebate Program. (2023, May 26). Federal Register. ; 2. Misclassification of Drugs, Program Administration and Program Integrity Updates Under the Medicaid Drug Rebate Program Notice for Proposed Rulemaking (CMS-2434-P) ;. 3. H .R.1319 - American Rescue Plan Act of 2021